Carbon Tax Budgeting – The commitment to Net Zero targets

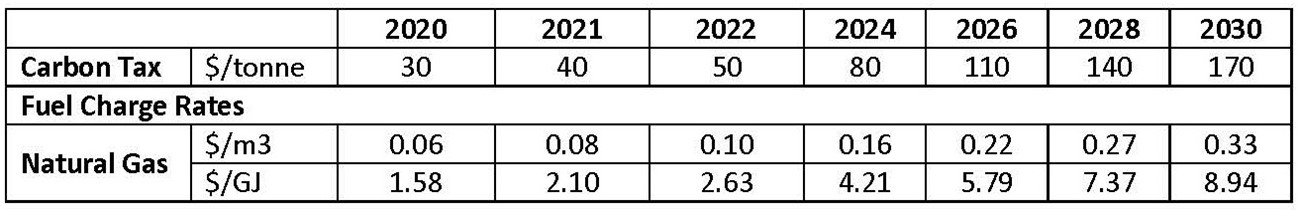

Canada’s policy makers remain committed to meeting net zero emissions targets by 2050. One key tenet being the increase in carbon pricing in Canada to at least $170CDN/tonne by 2030 to meet the goal.

The Carbon Tax was introduced in 2019 at $20 per tonne; it has increased by $10 per tonne each year until reaching $50 per tonne this April 2022. The goal, in part, is for Canada to meet its obligation to the Paris Agreement. That means cutting Canada's carbon pollution by 40% below 2005 levels by 2030, and to net zero by 2050.

Since we last wrote, the Liberal government has confirmed a planned increase from $50 per tonne in 2022 to $170 in 2030 through $15 annual increments. That higher levy will drive up the cost of gasoline, heating fuels, and electricity fired by fossil fuel for Canadian consumers and businesses.

Fuel Charge

The federal carbon tax applies to fuel producers and distributors who will pass on the costs to consumers. See below table for Federal Fuel Charge Rates applicable to natural gas for 2022, as well as the outlook heading up to 2030 based on the new approach outlined above:

The fuel charge appears on end-user monthly utility (i.e., Enbridge) invoices as a separate line item calculated on actual natural gas usage.

Impact to LAS Members

With the price currently set at $0.783/m3, end users can expect another increase come April 1/22, as the carbon tax will rise to almost $0.10/m3. It is strongly recommended that LAS members budget for the increase in natural gas costs effective April 1, 2022 as the charge has a significant cost impact, representing more than 25% of natural gas costs.

Looking even further ahead at the projected carbon tax increases through 2030, at a price of $170/tonnne this would represent nearly 60% of LAS program member’s natural gas costs (assuming the price of the natural gas commodity, deregulated transportation, and distribution remains relatively unchanged).

While there is debate about whether to use carbon pricing alone or in combination along with other climate policies to reach Canada’s emissions reduction targets, it is clear that carbon costs will continue to increase. End-use customers will need to understand the impact that these changes will have on their energy costs and should look for opportunities to better understand and navigate the choices and risks in managing energy. LAS will continue to monitor the situation closely and will provide members with regular updates regarding the impact of this charge.