Carbon Tax – Reducing Emissions and Driving Innovation

Carbon pricing is about recognizing the cost of pollution and accounting for those costs in daily decisions. Putting a price on carbon pollution is widely recognized as the most efficient means to reduce greenhouse gas emissions while also driving innovation.

Since 2019, every jurisdiction in Canada has had a price on carbon pollution. Canada’s approach is flexible: any province or territory can design its own pricing system tailored to local needs, or can choose the federal pricing system. The federal government sets minimum national stringency standards that all systems must meet to ensure they are comparable and contribute their fair share to reducing greenhouse gas emissions. If a province decides not to price pollution, or proposes a system that does not meet these standards, the federal system is put in place. This ensures consistency and fairness for all Canadians.

Under the Greenhouse Gas Pollution Pricing Act (GGPPA), adopted on June 21, 2018, the federal pricing system has two parts: a regulatory charge on fossil fuels like gasoline and natural gas, known as the fuel charge, and a performance-based system for industries, known as the Output-Based Pricing System. The fuel charge applies in Ontario, Manitoba, Yukon, Alberta, Saskatchewan and Nunavut. The Output-Based Pricing System applies in Manitoba, Prince Edward Island, the Yukon, Nunavut, and partially in Saskatchewan. All other provinces and territory are implementing their own pricing systems.

Provinces and territories that have their own carbon pricing systems use the proceeds as they see fit, including by supporting families to take further action to cut pollution in a practical and affordable way. When the Government of Canada implemented its backstop carbon pricing system in 2019, it committed to returning all direct proceeds from the federal backstop system to the jurisdiction of origin. Those governments that opted for the federal pricing system receive all the proceeds back to decide how to reinvest them.

Fuel Charge

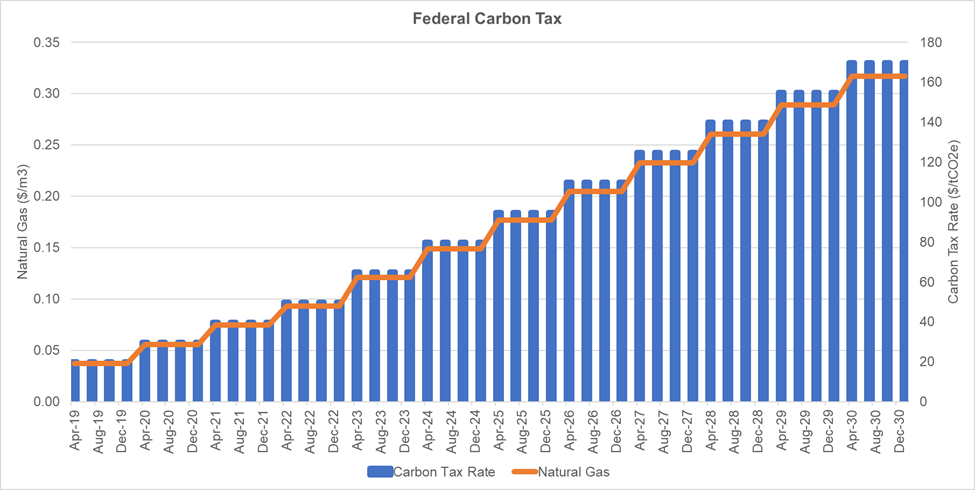

The federal carbon tax applies to fuel producers and distributors who will pass on the costs to consumers. See below table for Federal Fuel Charge Rates applicable to natural gas for 2023, as well as the outlook heading up to 2030:

Impact to LAS Members

With the price currently set at $0.093/m3, end users can expect another increase come April 1/23, as the carbon tax will rise to more than $0.12/m3. It is strongly recommended that LAS members budget for the increase in natural gas costs effective April 1, 2023 as the charge has a significant cost impact, representing more than 25% of natural gas costs.

Looking even further ahead at the projected carbon tax increasing to more than $0.30/m3 by 2030 this would represent nearly 60% of LAS program member’s natural gas costs (assuming the price of the natural gas commodity, deregulated transportation, and distribution remains relatively unchanged).