Federal Carbon Tax Update – March 2021

By Mike Nigro, Director, Gas Services, Canada

Edison Energy

Background

In 2019, the Federal Government of Canada announced that it would impose carbon tax in provinces and territories with no adequate emissions pricing plans of their own, to reduce Greenhouse Gas Emissions. The fuel charge assigns a value to each tonne of GHG emissions beginning at $20/tCO2e effective April 1, 2019 and increasing by $10 annually to $50/tCO2e in 2022. The federal carbon tax applies to fuel producers and distributors, who will pass on the costs to consumers.

The current plan in place continues to face heavy pushback from the provinces of Ontario, Alberta, Saskatchewan, and Manitoba. The appeals for the provinces of Ontario and Saskatchewan were presented to the Supreme Court back in September 2020. The ruling from the Supreme Court is still pending.

December 2020 Update on Federal Government Emission Reduction Plan

In mid-December 2020, the Federal Government released their updated strategy to dramatically reduce greenhouse gas emissions by 2030. The plan, "A Healthy Environment and A Healthy Economy", aims to reduce carbon emissions by 32%, which slightly exceeds the 2030 Paris targets to reduce emissions by 30% of 2005 levels by 2030.

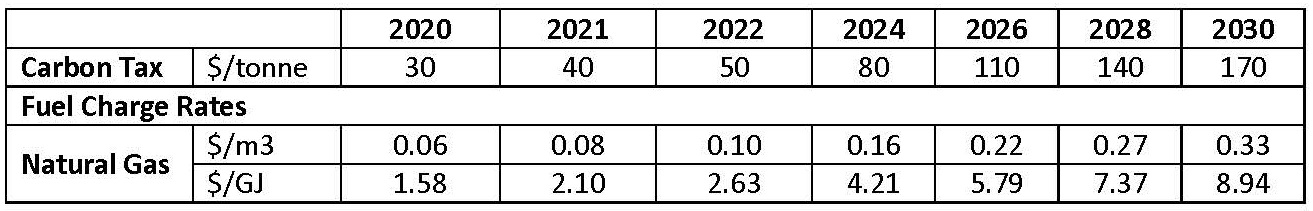

The approach involves billions in new funding for green vehicles and infrastructure, as well as changes to the Clean Fuel Standard set to take effect in late 2021. Among the most prominent details, though, is exactly how much the Federal Government plans to raise the levy on Greenhouse Gas Emissions. With this new initiative, the carbon tax would increase by $15/tonne each year starting in 2023 to deter consumers from fossil fuels in favor of cleaner energy sources. This announcement, if made into law, is expected to have a profound effect on many consumers, businesses, and industries in Canada. An eventual carbon tax rate of $170/tonne in 2030 equates to roughly $8.94/GJ (or $0.33/m3) for natural gas.

The federal carbon tax in Canada is set under the federal Greenhouse Gas Pollution Pricing Act (GGPPA). The GGPPA is a “back stop,” meaning it only applies if a province or territory does not have its own carbon pricing program that meets the federal benchmark. Like the current plan in place, the new proposal is expected to be met with aggressive push back on the provincial level and lead to additional litigation between the provincial and federal governments. A strong criticism of existing legislation is that there is no defined role that the provinces must play in the success of a national climate strategy.

Fuel Charge

The federal carbon tax applies to fuel producers and distributors who will pass on the costs to consumers. See below table for Federal Fuel Charge Rates applicable to natural gas for 2020-2022, as well as the outlook heading up to 2030 based on the new approach outlined above:

The fuel charge appears on end user monthly utility (i.e. Enbridge) invoices as a separate line item calculated on actual natural gas usage.

Impact to LAS Members

With the price currently set at $0.0587/m3, end users can expect another increase come April 1/21, as the carbon tax will rise to $0.0783/m3 (a 33% year over year increase). It is strongly recommended that LAS members budget for the increase in natural gas costs effective April 1, 2021 as the charge has a significant cost impact, representing approximately 25% of natural gas costs.

Looking even further ahead at the projected carbon tax increases through 2030, at a price of $170/tonne this would represent nearly 60% of LAS program member’s natural gas costs (assuming the price of the natural gas commodity, deregulated transportation, and distribution remains relatively unchanged).

While the federal carbon tax still faces its share of hurdles, LAS will continue to monitor the situation closely and will provide members with regular updates regarding the impact of this charge as the situation changes.

For any questions regarding the Federal Carbon Pricing System and the impact to LAS members, please contact LAS@LAS.on.ca, 416-971-9856